What is an FHA Loan?

An FHA finance is a mortgage that's insured by the Federal Housing Administration. The FHA doesn't create car loans itself but instead guarantees mortgage loans helped make through permitted lending institutions. This insurance safeguards creditors versus losses if consumers default on their finances.

One of the largest advantages of an FHA loan is that it enables customers to make a much smaller down repayment than they would need to have with a regular home loan. For instance, with an FHA lending, you can easily placed down as little bit of as 3.5% of the purchase rate. In add-on, credit requirements are often extra forgiving than with traditional lendings.

How to Certify for an FHA Loan

To certify for an FHA lending in Texas, you must fulfill certain eligibility criteria:

1. Minimum Credit Score

The minimum credit history score required for an FHA funding in Texas is 580 or higher. If your rating drops listed below this threshold, you may still be able to certify but will definitely need to have to placed down a bigger down remittance.

2. Maximum Loan Limit

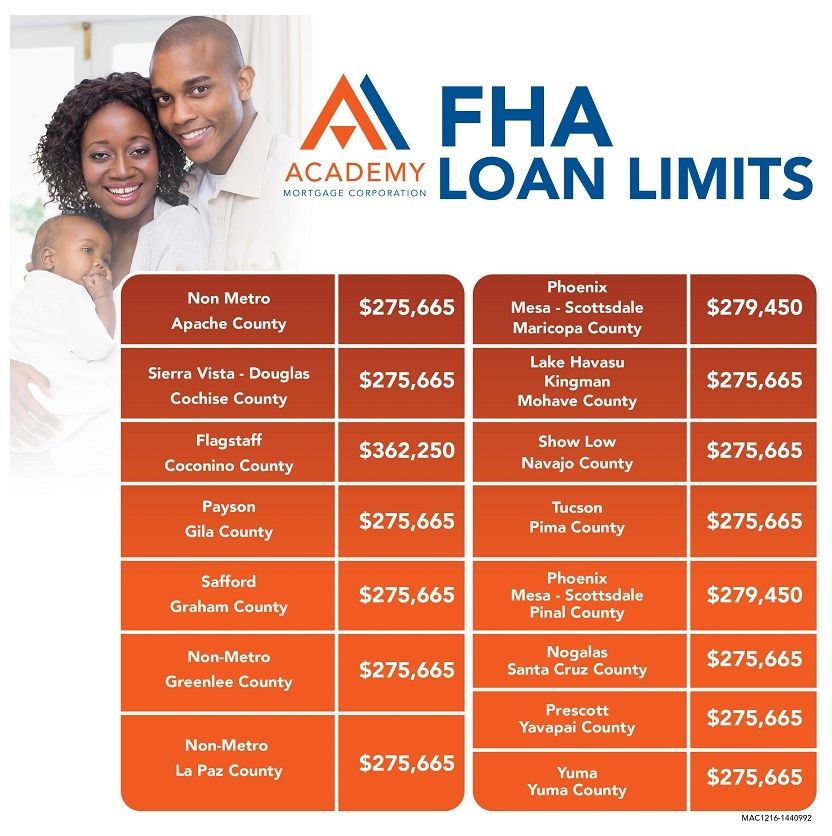

The optimal amount you may borrow along with an FHA financing depends on where you live and varies from $356,362 up to $822,375 in high-cost locations like Austin and Dallas-Fort Worth.

3. Debt-to-Income (DTI) Ratio

Your debt-to-income ratio (DTI) evaluates your month-to-month personal debt settlements compared to your disgusting regular monthly earnings prior to income taxes and various other deductions are taken out. The the greatest DTI proportion allowed under present suggestions is 43%, although some loan providers might offer much higher proportions for borrowers along with powerful credit scores and other compensating elements.

4. Job and Income Verification

FHA financial institutions will definitely call for verification of earnings and employment to make sure that you have a stable source of earnings to assist the home mortgage repayments. You'll need to offer income short ends, W-2s, tax yields, and various other records to validate your employment and revenue.

5. Property Appraisal

An FHA-approved appraiser will certainly review the property you're obtaining to ensure that it meets minimal residential or commercial property specifications. This assessment aids ensure that the house is risk-free, safe and secure, and structurally audio.

6. Mortgage Insurance Premium (MIP)

FHA lendings call for mortgage insurance policy superiors (MIP) upfront at closing as well as yearly for the lifestyle of the funding. The upfront MIP rate is presently 1.75% of the lending quantity, while the yearly MIP cost varies from 0.45% to 1.05%, depending on your down settlement amount and lending phrase.

7. Residency Criteria

To qualify for an FHA car loan in Texas, you have to be a legal local of the United States along with a valid Social Security amount or Alien Registration Number.

Standards to Think about When Applying for an FHA Loan along with Maximum Limit

Here are some added standards you need to take into consideration when using for an FHA finance with the greatest limitation:

1. Credit Score Improvement

If your credit scores score is below 580, take into consideration